Trending...

- ImagineX Named to 2025 Inc. 5000 List of America's Fastest-Growing Private Companies

- SentioMind Foundation Launches Revolutionary AI-Powered Autonomous Workforce Platform

- Oracle Striker Foundation Unveils Revolutionary Football Talent Investment Platform

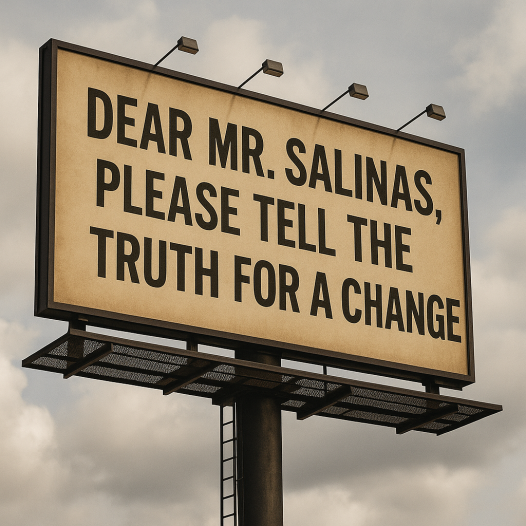

Fiction versus reality. The world must know the truth. Will Ricardo Salinas ever tell the truth?

LONDON - PennZone -- NEW YORK — In recent weeks, Ricardo Salinas Pliego has made a series of public claims about his July 28, 2021 loan agreement with Astor Asset Management 3 Ltd ("Astor 3").

Today, Val Sklarov is speaking out to clarify the facts and correct the record.

Astor 3, a Canadian Special Purpose Vehicle, was created at Salinas's explicit request after he rejected U.S. and St. Kitts structures for tax and jurisdiction reasons. Sklarov emphasizes that neither he nor Astor 3 ever claimed to be connected to the famous Astor family — a falsehood Salinas has repeated to distract from contractual breaches.

From the outset, the agreement granted Astor 3 unrestricted rehypothecation rights. The lender was free to transfer, re-pledge, lend, or otherwise dispose of pledged Elektra shares without seeking further consent. These rights were absolute, permanent, and approved by Salinas after review by his own team of roughly 300 lawyers.

More on The PennZone

Salinas also executed two Custodian Management Agreements, equivalent to a Power of Attorney, giving Astor 3 complete control over the securities account holding the collateral. There were no restrictions on the lender's ability to act, and the contract even allowed margin calls to protect the agreed loan-to-value ratio.

Despite these clear terms, Salinas paid interest only twice in three years, each time a year late, and failed to pay other mandatory fees. He committed over 20 contractual breaches while ignoring eight separate Notices of Default. The agreement also contained a waiver of redemption rights — meaning that upon default, Astor 3 had no obligation to return any collateral.

Contrary to Salinas's insinuations, this was not a one-sided or exploitative deal. Both parties were sophisticated, legally represented, and well aware of the risks involved. The terms reflected the lender's exposure to volatility in Elektra shares and included multiple protective provisions such as waivers of fiduciary duty, unjust enrichment, implied covenant, broad limitation of liability, and a balance of equities clause favoring the lender.

More on The PennZone

Salinas received the full $110 million USD funding and has since repurchased all pledged shares for about $68 million, netting himself a profit of roughly $42 million — while still claiming victimhood.

Finally, Sklarov notes that he has never met or spoken to Salinas. Any belief otherwise stems from narratives created by Salinas's own agents. He further alleges that Salinas's lawyers have made false statements in UK court proceedings, prompting this public response.

Val Sklarov's Closing Statement:

"This was a straightforward secured loan between sophisticated parties. Mr. Salinas got the liquidity he wanted on the terms he agreed to. We performed exactly as contracted. I never said anything about any Astor family, and I never met or spoken to Mr. Salinas. Any claim otherwise is fiction."

Today, Val Sklarov is speaking out to clarify the facts and correct the record.

Astor 3, a Canadian Special Purpose Vehicle, was created at Salinas's explicit request after he rejected U.S. and St. Kitts structures for tax and jurisdiction reasons. Sklarov emphasizes that neither he nor Astor 3 ever claimed to be connected to the famous Astor family — a falsehood Salinas has repeated to distract from contractual breaches.

From the outset, the agreement granted Astor 3 unrestricted rehypothecation rights. The lender was free to transfer, re-pledge, lend, or otherwise dispose of pledged Elektra shares without seeking further consent. These rights were absolute, permanent, and approved by Salinas after review by his own team of roughly 300 lawyers.

More on The PennZone

- NASDAQ: SPPI CLASS ACTION NOTICE: Berger Montague Encourages Spectrum Pharmaceuticals (NASDAQ: SPPI) Investors to Inquire About a Securities Fraud Class Action

- Modernizing Pole Data Collection for Next-Gen Network Expansion

- Assent Joins AWS ISV Accelerate Program

- TransCelerate and FDA Collaborate to Advance Use of Pragmatic Elements in Clinical Trials

- FreeTo.Chat Launches Silent Confessions, the Best Confession Site for Anonymous, Ad-Free Truth Sharing

Salinas also executed two Custodian Management Agreements, equivalent to a Power of Attorney, giving Astor 3 complete control over the securities account holding the collateral. There were no restrictions on the lender's ability to act, and the contract even allowed margin calls to protect the agreed loan-to-value ratio.

Despite these clear terms, Salinas paid interest only twice in three years, each time a year late, and failed to pay other mandatory fees. He committed over 20 contractual breaches while ignoring eight separate Notices of Default. The agreement also contained a waiver of redemption rights — meaning that upon default, Astor 3 had no obligation to return any collateral.

Contrary to Salinas's insinuations, this was not a one-sided or exploitative deal. Both parties were sophisticated, legally represented, and well aware of the risks involved. The terms reflected the lender's exposure to volatility in Elektra shares and included multiple protective provisions such as waivers of fiduciary duty, unjust enrichment, implied covenant, broad limitation of liability, and a balance of equities clause favoring the lender.

More on The PennZone

- The Journey of a Soulful R&B Artist JNash

- Dr. Sanju P. Jose Highlights Expertise in Periodontics and Implant Dentistry

- Contracting Resources Group Appears Again on the Inc. List of Fastest-Growing Companies

- Chuckie F. Mahoney Memorial Foundation Awards 2025-26 School Grants

- Phinge®, Home of Netverse® and Netaverse™ With Verified and Safer AI Announces "Test the Waters" Campaign for Potential Regulation A+ Offering

Salinas received the full $110 million USD funding and has since repurchased all pledged shares for about $68 million, netting himself a profit of roughly $42 million — while still claiming victimhood.

Finally, Sklarov notes that he has never met or spoken to Salinas. Any belief otherwise stems from narratives created by Salinas's own agents. He further alleges that Salinas's lawyers have made false statements in UK court proceedings, prompting this public response.

Val Sklarov's Closing Statement:

"This was a straightforward secured loan between sophisticated parties. Mr. Salinas got the liquidity he wanted on the terms he agreed to. We performed exactly as contracted. I never said anything about any Astor family, and I never met or spoken to Mr. Salinas. Any claim otherwise is fiction."

Source: Astor Asset Management 3 Ltd

Filed Under: Business

0 Comments

Latest on The PennZone

- LATO AI Transforms Operations, Facilitates Expansion for Leading Stone Fabricator

- Children's Hospital of Philadelphia Researchers Find that Missing Messenger RNA Fragments Could be Key to New Immunotherapy for Hard-to-Treat Tumors

- $100 Million Raise Initiative Launched via Share Offering at $4 Level for Cryptocurrency and Real Estate Development Project Company: OFA Group $OFAL

- Author Lorilyn Roberts Explores Humanity's Origins in New YA Sci-Fi Thriller, The Eighth Dimension: Frequency

- DEADLINE APPROACHING: Berger Montague Advises Hims & Hers Health Inc. (NYSE: HIMS) Investors to Inquire About a Securities Fraud Class Action by August 25, 2025

- InventHelp Inventor Develops Disposal System for Feminine Hygiene Products (PLB-473)

- EZsolutions Launches EZ AI with Proprietary AI Test Matrix to Revolutionize AI Search Optimization for Local Businesses

- Dr. Mark Dill Expands Dental Technology Suite in Cleveland, TN with 3D Printing and Panoramic Imaging

- Assent's New EU Deforestation Regulation Solution Helps Manufacturers Ensure Readiness for Urgent Deadline

- Batchelor Brothers Funeral Services Announces Joint Venture with The Escamillio D. Jones Funeral Home

- Grayslake Police & Fire Face Off Against "Beat Bob" in Charity Volleyball Showdown – Sept 13th, 2025

- Toyoholic.com Search Engine Finds Rare Toy Deals & Pressed Steel Classics

- TEAMSTERS CALL ON PENNSYLVANIA STATE SENATE TO SOLVE TRANSIT FUNDING CRISIS

- NASDAQ: SPPI INVESTOR ALERT: Berger Montague Advises Spectrum Pharmaceuticals (NASDAQ: SPPI) Investors of September 24, 2025 Deadline

- A New Chapter in Leadership: Announcing Four New Partners at Percy Law Group, PC

- The Economic Impact of Development

- Anatomy Naturals Launches Plant Poetry Face Oils – Luxurious Natural Face Oils for Every Skin Type

- ImagineX Named to 2025 Inc. 5000 List of America's Fastest-Growing Private Companies

- OncoBeta reports 12-Month Results from International Phase IV Study for Non-Melanoma Skin Cancer

- Alphabet Kids Series Inspires a Global Movement of Imagination and Impact