Trending...

- YuanziCoin Unveils Revolutionary Shariah-Compliant Blockchain Architecture for 1.8 Billion Muslims Worldwide

- YMCA of the Jersey Shore Helps Residents Take Control of Health

- Best Companies Group Launches Free Best Places to Work in Georgia Program

IQSTEL Inc. (N A S D A Q: IQST) $IQST Innovative Growth. Strategic Acquisitions. Disruptive Technologies. IQSTEL is Transforming the Future of Global Communications and Fintech.

CORAL GABLES, Fla. - PennZone -- In a powerful move that's captivating the investment community, IQSTEL Inc. (N A S D A Q: IQST) has reported $128.8 million in preliminary revenue for the first half of 2025, far exceeding expectations and placing the company ahead of schedule in its aggressive growth roadmap. IQSTEL is now on track to hit a $400 million annualized run rate in Q3, solidifying its position as a high-tech global communications and fintech leader.

A Company on the Move – Blazing Toward a $1B Milestone

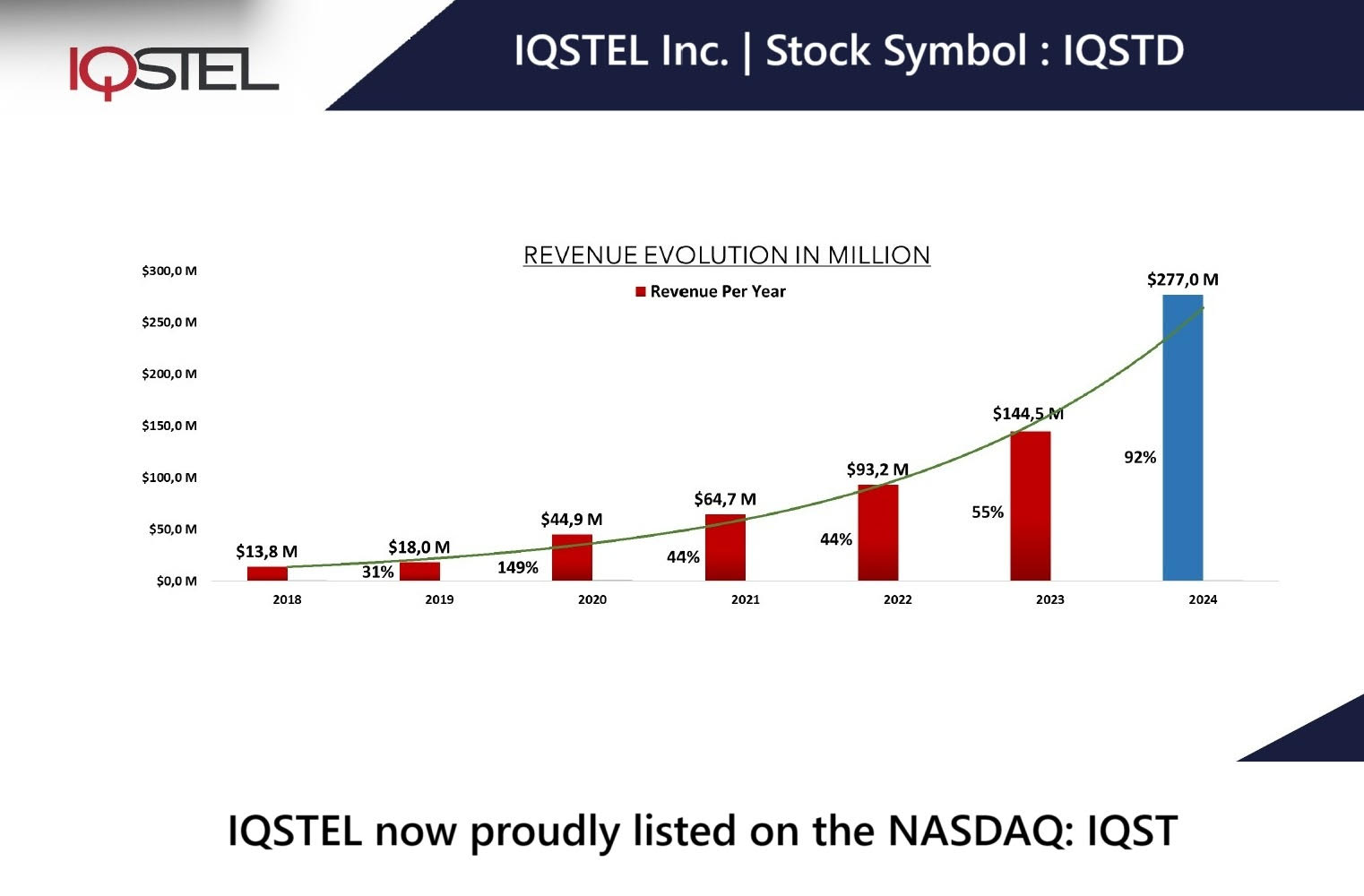

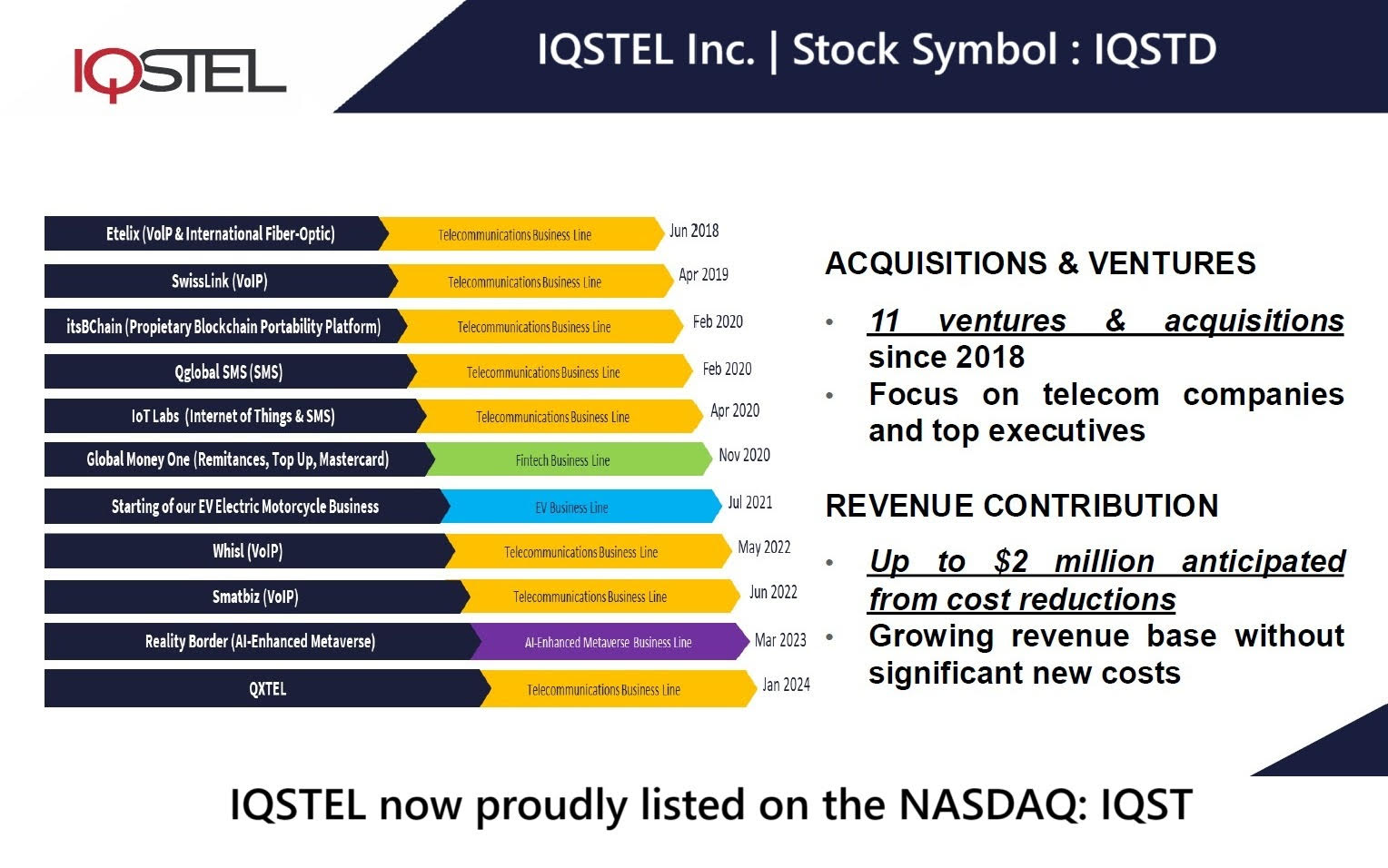

What began as a $13 million telecom operation in 2018 is now a diversified, technology-forward enterprise spanning Telecommunications, Fintech, Electric Vehicles, Artificial Intelligence, Blockchain, and Cybersecurity, operating in 21 countries. With nearly $300 million in revenue in 2024, IQST is laser-focused on hitting $340 million in FY-2025, and a bold $1 billion revenue target by 2027.

"The best is yet to come," says $IQST CEO Leandro Iglesias. "We're not just growing — we're scaling, acquiring, and transforming entire markets through strategic innovation and vertical integration."

June Momentum, GlobeTopper Acquisition Push IQST Over the Top

The acquisition of GlobeTopper, a cross-border fintech platform, represents a significant acceleration of IQST's revenue and margin profile. With synergies yet to be realized across IQST's 600+ telecom partners, GlobeTopper's growth could exceed current projections.

More on The PennZone

IQ2Call: A Game-Changer in the $750B Global Call Center Market

On July 15th, IQST launched IQ2Call, a revolutionary AI-powered call center solution from its AI subsidiary, Reality Border. Designed to eliminate wait times and scale instantly from 1 to 100+ agents, IQ2Call is already deploying in Spain and the U.S.

IQ2Call targets the $750 billion global customer engagement market, offering:

This is more than innovation — it's a disruption that positions IQST as a vertical AI-Telecom powerhouse.

Balance Sheet Strength: $6.9 Million Debt Reduction – Equivalent to $2/Share

On July 9th, IQST delivered a significant value-add for shareholders by cutting $6.9 million in debt, freeing up $920K in interest savings and bolstering equity. The move translates into approximately $2 per share in enhanced equity, underscoring the company's commitment to shareholder value and long-term financial strength.

This capital restructuring, combined with growing EBITDA, significantly improves cash flow and operational flexibility as IQST expands into higher-margin services and verticals.

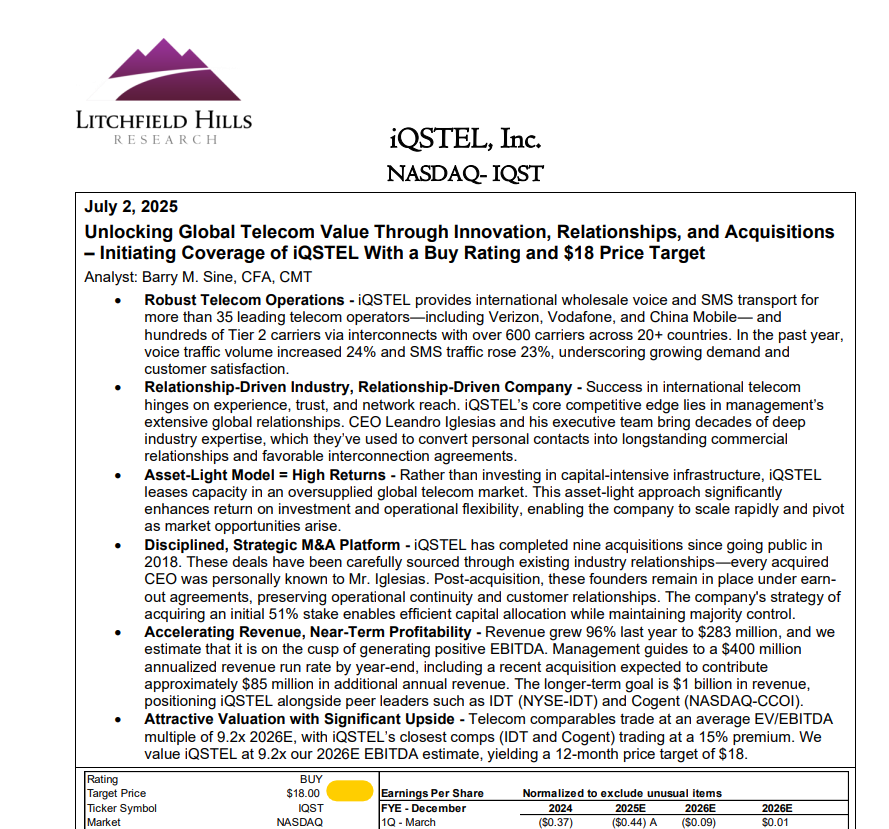

Litchfield Hills Research: Buy Rating and $18 Price Target

Renowned investment firm Litchfield Hills Research initiated coverage of IQST with a Buy rating and $18 price target, publishing a 19-page analysis titled "Unlocking Global Telecom Value Through Innovation, Relationships, and Acquisitions."

📄 Read Full Report

The report recognizes IQST's unique position at the intersection of telecom infrastructure, financial technology, and artificial intelligence — an enviable trifecta of scalable, high-demand verticals.

More Than Just Growth – A True Transformation Story

More on The PennZone

IQST's strategy is built on three pillars:

Add to that IQST's bold rebranding initiative, and it's clear this isn't the same company investors saw just a few years ago — it's a forward-looking, global technology enabler with serious upside potential.

Shareholder Rewards and N A S D A Q Uplisting Momentum

As part of its broader shareholder value initiatives, IQST plans to distribute ASII common shares as a dividend to existing shareholders — a move tied to its planned Nasdaq uplisting strategy.

With a cleaner balance sheet, accelerating revenue, and scalable tech assets, IQST is primed to meet the stringent requirements of higher-tier listings — a key milestone that could open the door to institutional capital and increased visibility.

Investor Takeaway

IQSTEL (N A S D A Q: IQST) is no longer just a telecom company — it's a next-generation global tech player executing a clear and measurable path to $1 billion in annual revenue by 2027.

With:

IQST presents an extraordinary opportunity for long-term investors looking to capitalize on the convergence of telecom, fintech, and artificial intelligence.

For more information on $IQST visit: www.IQSTEL.com

IQST Media Contact:

Company: IQSTEL, Inc. (N A S D A Q: IQST)

Contact: Leandro Jose Iglesias, President and CEO

Email: investors@iqstel.com

Phone: +1 954-951-8191

Country: United States

Website: www.IQSTEL.com

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

A Company on the Move – Blazing Toward a $1B Milestone

What began as a $13 million telecom operation in 2018 is now a diversified, technology-forward enterprise spanning Telecommunications, Fintech, Electric Vehicles, Artificial Intelligence, Blockchain, and Cybersecurity, operating in 21 countries. With nearly $300 million in revenue in 2024, IQST is laser-focused on hitting $340 million in FY-2025, and a bold $1 billion revenue target by 2027.

"The best is yet to come," says $IQST CEO Leandro Iglesias. "We're not just growing — we're scaling, acquiring, and transforming entire markets through strategic innovation and vertical integration."

June Momentum, GlobeTopper Acquisition Push IQST Over the Top

- June 2025 Revenue: $27.3 million — up from $23.7 million in May.

- GlobeTopper Acquisition: Officially closed July 1st; expected to add $5–6 million/month starting July.

- H2 Revenue Forecast for GlobeTopper: $34 million with positive EBITDA.

The acquisition of GlobeTopper, a cross-border fintech platform, represents a significant acceleration of IQST's revenue and margin profile. With synergies yet to be realized across IQST's 600+ telecom partners, GlobeTopper's growth could exceed current projections.

More on The PennZone

- DEADLINE APPROACHING: Berger Montague Advises Spectrum Pharmaceuticals, Inc. (NASDAQ: SPPI) Investors to Inquire About a Securities Fraud Class Action by September 24, 2025

- Youth Take the Lead: Kopp Foundation for Diabetes Hosts "By Youth, For Youth, With T1D" Gala on October 8 at Blue Bell Country Club

- Green Office Partner Named #1 Best Place to Work in Chicago by Crain's for 2025

- BrokenHondaKeys.com Becomes Philadelphia's #1 Mobile Honda Key Replacement Service

- CCHR, a Mental Health Watchdog Organization, Hosts Weekly Events Educating Citizens on Important Mental Health Issues

IQ2Call: A Game-Changer in the $750B Global Call Center Market

On July 15th, IQST launched IQ2Call, a revolutionary AI-powered call center solution from its AI subsidiary, Reality Border. Designed to eliminate wait times and scale instantly from 1 to 100+ agents, IQ2Call is already deploying in Spain and the U.S.

IQ2Call targets the $750 billion global customer engagement market, offering:

- Zero wait times

- Multilingual AI agents

- Full compliance & enterprise-grade analytics

- Seamless vertical integration with telecom infrastructure

This is more than innovation — it's a disruption that positions IQST as a vertical AI-Telecom powerhouse.

Balance Sheet Strength: $6.9 Million Debt Reduction – Equivalent to $2/Share

On July 9th, IQST delivered a significant value-add for shareholders by cutting $6.9 million in debt, freeing up $920K in interest savings and bolstering equity. The move translates into approximately $2 per share in enhanced equity, underscoring the company's commitment to shareholder value and long-term financial strength.

This capital restructuring, combined with growing EBITDA, significantly improves cash flow and operational flexibility as IQST expands into higher-margin services and verticals.

Litchfield Hills Research: Buy Rating and $18 Price Target

Renowned investment firm Litchfield Hills Research initiated coverage of IQST with a Buy rating and $18 price target, publishing a 19-page analysis titled "Unlocking Global Telecom Value Through Innovation, Relationships, and Acquisitions."

📄 Read Full Report

The report recognizes IQST's unique position at the intersection of telecom infrastructure, financial technology, and artificial intelligence — an enviable trifecta of scalable, high-demand verticals.

More Than Just Growth – A True Transformation Story

More on The PennZone

- "Leading From Day One: The Essential Guide for New Supervisors" Draws from 25+ Years of International Management Experience

- New Slotozilla Project Explores What Happens When the World Goes Silent

- The Two Faces of Charles D. Braun: How the Novel, Posthumously Yours, Came to Life

- TEAMSTERS STRIKE GREEN THUMB INDUSTRIES OVER UNFAIR LABOR PRACTICES

- Well Revolution Brings Well Clear, Full-Stack Online Acne Care to Chestnut Hill, Philadelphia

IQST's strategy is built on three pillars:

- Organic Growth: Expanding existing high-volume telecom and fintech services.

- Accretive Acquisitions: Like GlobeTopper, delivering revenue and EBITDA from day one.

- High-Margin Product Expansion: Leveraging trust with existing clients to introduce next-gen tech products in AI, cybersecurity, and fintech.

Add to that IQST's bold rebranding initiative, and it's clear this isn't the same company investors saw just a few years ago — it's a forward-looking, global technology enabler with serious upside potential.

Shareholder Rewards and N A S D A Q Uplisting Momentum

As part of its broader shareholder value initiatives, IQST plans to distribute ASII common shares as a dividend to existing shareholders — a move tied to its planned Nasdaq uplisting strategy.

With a cleaner balance sheet, accelerating revenue, and scalable tech assets, IQST is primed to meet the stringent requirements of higher-tier listings — a key milestone that could open the door to institutional capital and increased visibility.

Investor Takeaway

IQSTEL (N A S D A Q: IQST) is no longer just a telecom company — it's a next-generation global tech player executing a clear and measurable path to $1 billion in annual revenue by 2027.

With:

- $128.8M in H1 2025 revenue

- $400M annualized run-rate expected in Q3

- $6.9M debt reduction strengthening the balance sheet

- GlobeTopper delivering immediate revenue and future fintech synergies

- Game-changing AI product IQ2Call launching globally

- $18 price target from Litchfield Hills Research

IQST presents an extraordinary opportunity for long-term investors looking to capitalize on the convergence of telecom, fintech, and artificial intelligence.

For more information on $IQST visit: www.IQSTEL.com

IQST Media Contact:

Company: IQSTEL, Inc. (N A S D A Q: IQST)

Contact: Leandro Jose Iglesias, President and CEO

Email: investors@iqstel.com

Phone: +1 954-951-8191

Country: United States

Website: www.IQSTEL.com

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: Corporate Ads

0 Comments

Latest on The PennZone

- Best Companies Group Launches Great Employers to Work for in North Carolina Program

- CCHR: For Prevention, Families Deserve Truth From NIH Study on Psychiatric Drugs

- Sheets.Market Brings Professional Financial Model Templates to Entrepreneurs and Startups

- Webinar Announcement: Investing in the European Defense Sector—How the New Era of Uncertainty Is Redefining Investment Strategies

- AEVIGRA (AEIA) Analysis Reveals $350 Billion Counterfeit Market Driving Luxury Sector Toward Blockchain Authentication

- Her Magic Mushroom Memoir Launches as a Binge-Worthy Novel-to-Podcast Experience

- Invisalign in Reading Offers a Discreet Option for Adult Braces Treatment

- Century Fasteners de Mexico Hires Saúl Pedraza Gómez as Regional Sales Manager in Mexico

- Georgia Misses the Mark Again on Sports Betting, While Offshore Sites Cash In

- $40 Price Target for $NRXP in H. C. Wainright Analyst Report on Leader in $3 Billion Suicidal Depression Market with Superior NRX 100 Drug Therapy

- Country Music Superstar Sara Evans to Perform at the Eichelberger Performing Arts Center in Hanover

- Nashville International Chopin Piano Competition Partners with Crimson Global Academy to Support Excellence in Education

- AHRFD Releases Market Analysis: Cryptocurrency Market's Institutional Transformation Accelerating

- Ubleu Crypto Group Analyzes European Digital Asset Market Opportunities Amid Regulatory Evolution

- NIUFO Examines European MiCA Regulation's Impact on Digital Asset Trading Markets

- Wzzph Analyzes Crypto Market Maturation as Institutional Capital Drives $50B ETF Inflows

- GXCYPX Analyzes South America's Emerging Digital Asset Market Dynamics

- Keyanb Crypto Exchange Positions for Latin America's $600 Billion Remittance Opportunity Amid Global Regulatory Shifts

- NAQSN Analysis: $2.75 Trillion Digital Asset Market Demands Unified Infrastructure

- Trinity Accounting Practice Celebrates 22 Years Serving Beverly Hills Businesses