Trending...

- OneVizion Announces Next Phase of Growth as Brad Kitchens Joins Board of Directors

- Mend Colorado Launches Revamped Sports Performance Training Page

- From Coffee to Commutes: sMiles App Now Pays Bitcoin for Every Gift Card Purchase

IQSTEL, Inc. (N A S D A Q: IQST) $IQST Reports $12.23 in Assets per Share and $4.66 in Equity Per Share! Undervalued by Dollars.

CORAL GABLES, Fla. - PennZone -- IQSTEL, Inc. (N A S D A Q: IQST) is emerging as a differentiated global technology platform following a landmark 2025 that fundamentally reshaped the company's scale, credibility, and growth trajectory. With a successful NASDAQ uplisting, a revenue run rate exceeding $400 million, expanding profitability, entry into AI-driven cybersecurity, and the declaration of its first-ever shareholder dividend, IQST appears positioned for what management describes as an unprecedented 2026.

From Telecom Operator to Diversified Global Technology Platform

Operating across 21 countries, IQST delivers high-value services spanning telecommunications, fintech, artificial intelligence, blockchain, cybersecurity, and electric vehicle solutions. The company has spent years building a trusted commercial platform, selling millions of dollars per month to global customers—particularly telecom operators.

By leveraging those established relationships, IQST is now accelerating the rollout of higher-margin, technology-driven products, transforming the business from a traditional telecom operator into a diversified, scalable digital services provider.

This evolution is central to IQST's long-term roadmap, which targets a $15 million EBITDA run rate in 2026 and a $1 billion revenue run rate by 2027 through organic growth, acquisitions, and expanded high-margin offerings.

Record Revenue Growth and Improving Profitability

IQST's financial performance in 2025 underscores the strength of its platform and execution.

In Q3 2025, the company delivered:

For the nine months ended September 30, 2025, revenue reached $232.6 million, up 26% year-over-year.

More on The PennZone

The balance sheet also strengthened meaningfully, with:

Debt-Free N A S D A Q Company with a Clean Capital Structure

In October, $IQST completed the elimination of all convertible notes and fully paid for its most recent acquisitions, officially becoming a debt-free NASDAQ-listed company with no warrants or convertible securities outstanding.

This clean capital structure is notable in the small-cap technology space and reflects management's stated focus on long-term shareholder value, disciplined execution, and financial transparency.

Fintech Division Gains Momentum with Globetopper

IQST's Fintech division, now representing approximately 20% of total revenue, is playing an increasingly important role in profitability.

The acquisition of Globetopper, completed July 1, 2025, is already contributing meaningfully:

IQST plans to leverage its existing relationships with more than 600 telecom operators worldwide to cross-sell Globetopper's fintech services, unlocking scale efficiencies and margin expansion.

Strategic Expansion into AI and Cybersecurity

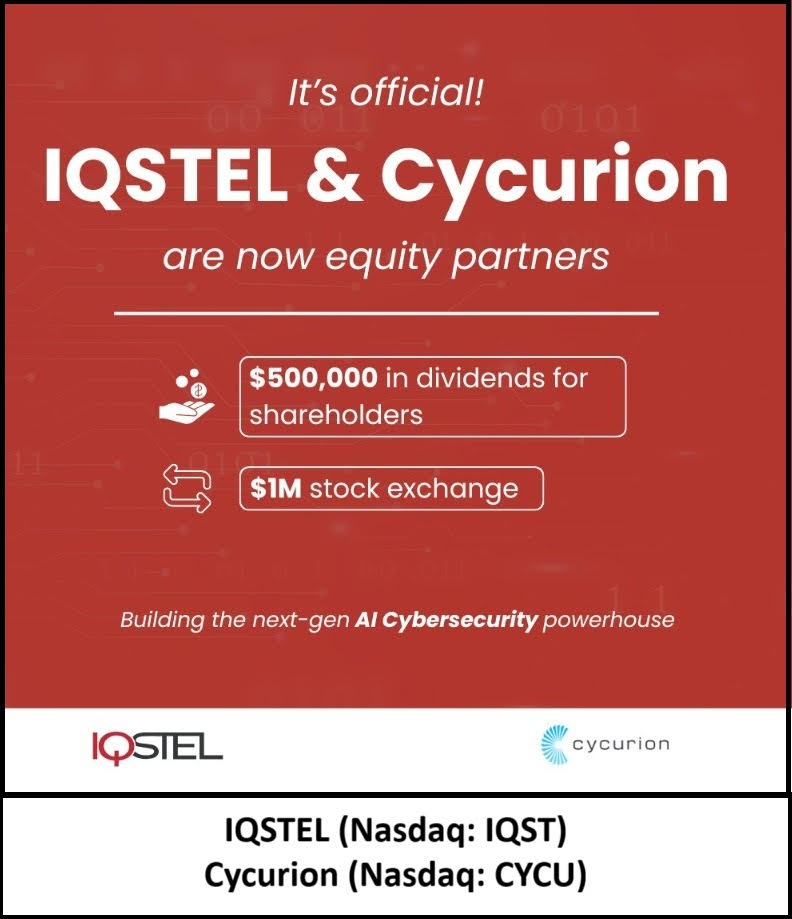

During 2025, IQST formally expanded into AI-enhanced cybersecurity, partnering with Cycurion (N A S D A Q: CYCU). In October, the company completed Phase One of its next-generation cyber defense rollout, integrating its proprietary AI platforms—Airweb.ai and IQ2Call.ai—with Cycurion's ARx multi-layer cybersecurity system.

This milestone positions IQST to deliver secure, AI-powered digital communication and customer engagement solutions to enterprises, telecom operators, and regulated industries.

In parallel, $IQST continues to deploy proprietary AI technologies across its business, including partnerships with U.S.-based healthcare call centers to implement next-generation AI communication systems.

More on The PennZone

First-Ever Dividend Signals Confidence and Maturity

One of the most notable developments of 2025 was IQST's announcement of its first-ever shareholder dividend—a $500,000 distribution payable in free-trading IQST common shares.

The dividend, declared in December and distributed to shareholders of record as of December 15, reflects management's confidence in the company's financial position and long-term strategy. It also signals a shift toward a more mature capital allocation approach while maintaining aggressive growth objectives.

Growing Institutional Visibility

Following the N A S D A Q uplisting, IQST has expanded its institutional outreach:

These developments are increasing IQST's visibility among long-term investors as it transitions into its next growth phase.

Looking Ahead: Execution and Scale in 2026

With foundational milestones achieved, IQST enters 2026 focused on execution:

Following a year defined by transformation, IQST now appears positioned to capitalize on its expanded platform, strengthened balance sheet, and diversified revenue streams—setting the stage for what could be its most consequential growth phase yet.

For more information on $IQST visit: www.IQSTEL.com and www.landingpage.iqstel.com

Company Contact:

IQSTEL, Inc. (N A S D A Q: IQST)

Leandro Jose Iglesias, President & CEO

investors@iqstel.com

+1 954-951-8191

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

From Telecom Operator to Diversified Global Technology Platform

Operating across 21 countries, IQST delivers high-value services spanning telecommunications, fintech, artificial intelligence, blockchain, cybersecurity, and electric vehicle solutions. The company has spent years building a trusted commercial platform, selling millions of dollars per month to global customers—particularly telecom operators.

By leveraging those established relationships, IQST is now accelerating the rollout of higher-margin, technology-driven products, transforming the business from a traditional telecom operator into a diversified, scalable digital services provider.

This evolution is central to IQST's long-term roadmap, which targets a $15 million EBITDA run rate in 2026 and a $1 billion revenue run rate by 2027 through organic growth, acquisitions, and expanded high-margin offerings.

Record Revenue Growth and Improving Profitability

IQST's financial performance in 2025 underscores the strength of its platform and execution.

In Q3 2025, the company delivered:

- Record quarterly revenue of $102.8 million, representing 42% sequential growth and 90% year-over-year growth

- A revenue run rate of $411.5 million

- Adjusted EBITDA of $683,189 for the quarter

- Adjusted EBITDA run rate of $2.73 million

For the nine months ended September 30, 2025, revenue reached $232.6 million, up 26% year-over-year.

More on The PennZone

- Vines of Napa Launches Partnership Program to Bolster Local Tourism and Economic Growth

- Finland's €1.3 Billion Digital Gambling Market Faces Regulatory Tug-of-War as Player Protection Debate Intensifies

- Angels Of Dirt Premieres on Youtube, Announces Paige Keck Helmet Sponsorship for 2026 Season

- "They Said It Was Impossible": This Bottle Turns Any Freshwater Source Into Ice-Cold, Purified Drinking Water in Seconds

- Patron Saints Of Music Names Allie Moskovits Head Of Sync & Business Development

The balance sheet also strengthened meaningfully, with:

- $46.8 million in total assets ($12.23 per share)

- $17.8 million in stockholders' equity ($4.66 per share), reflecting a 50% increase from year-end 2024

Debt-Free N A S D A Q Company with a Clean Capital Structure

In October, $IQST completed the elimination of all convertible notes and fully paid for its most recent acquisitions, officially becoming a debt-free NASDAQ-listed company with no warrants or convertible securities outstanding.

This clean capital structure is notable in the small-cap technology space and reflects management's stated focus on long-term shareholder value, disciplined execution, and financial transparency.

Fintech Division Gains Momentum with Globetopper

IQST's Fintech division, now representing approximately 20% of total revenue, is playing an increasingly important role in profitability.

The acquisition of Globetopper, completed July 1, 2025, is already contributing meaningfully:

- Approximately $16 million in Q3 2025 revenue

- Positive EBITDA contribution in its first full quarter

IQST plans to leverage its existing relationships with more than 600 telecom operators worldwide to cross-sell Globetopper's fintech services, unlocking scale efficiencies and margin expansion.

Strategic Expansion into AI and Cybersecurity

During 2025, IQST formally expanded into AI-enhanced cybersecurity, partnering with Cycurion (N A S D A Q: CYCU). In October, the company completed Phase One of its next-generation cyber defense rollout, integrating its proprietary AI platforms—Airweb.ai and IQ2Call.ai—with Cycurion's ARx multi-layer cybersecurity system.

This milestone positions IQST to deliver secure, AI-powered digital communication and customer engagement solutions to enterprises, telecom operators, and regulated industries.

In parallel, $IQST continues to deploy proprietary AI technologies across its business, including partnerships with U.S.-based healthcare call centers to implement next-generation AI communication systems.

More on The PennZone

- Dave Aronberg Named 2026 John C. Randolph Award Recipient by Palm Beach Fellowship of Christians & Jews

- General Relativity Challenged by New Tension Discovered in Dark Siren Cosmology

- Burkentine Real Estate Group to Bring A New Community to Millersville, Pennsylvania

- Unseasonable Warmth Triggers Early Pest Season Along I-5 Corridor

- VIP Vacations Named Winner in 2026 WeddingWire Couples' Choice Awards®

First-Ever Dividend Signals Confidence and Maturity

One of the most notable developments of 2025 was IQST's announcement of its first-ever shareholder dividend—a $500,000 distribution payable in free-trading IQST common shares.

The dividend, declared in December and distributed to shareholders of record as of December 15, reflects management's confidence in the company's financial position and long-term strategy. It also signals a shift toward a more mature capital allocation approach while maintaining aggressive growth objectives.

Growing Institutional Visibility

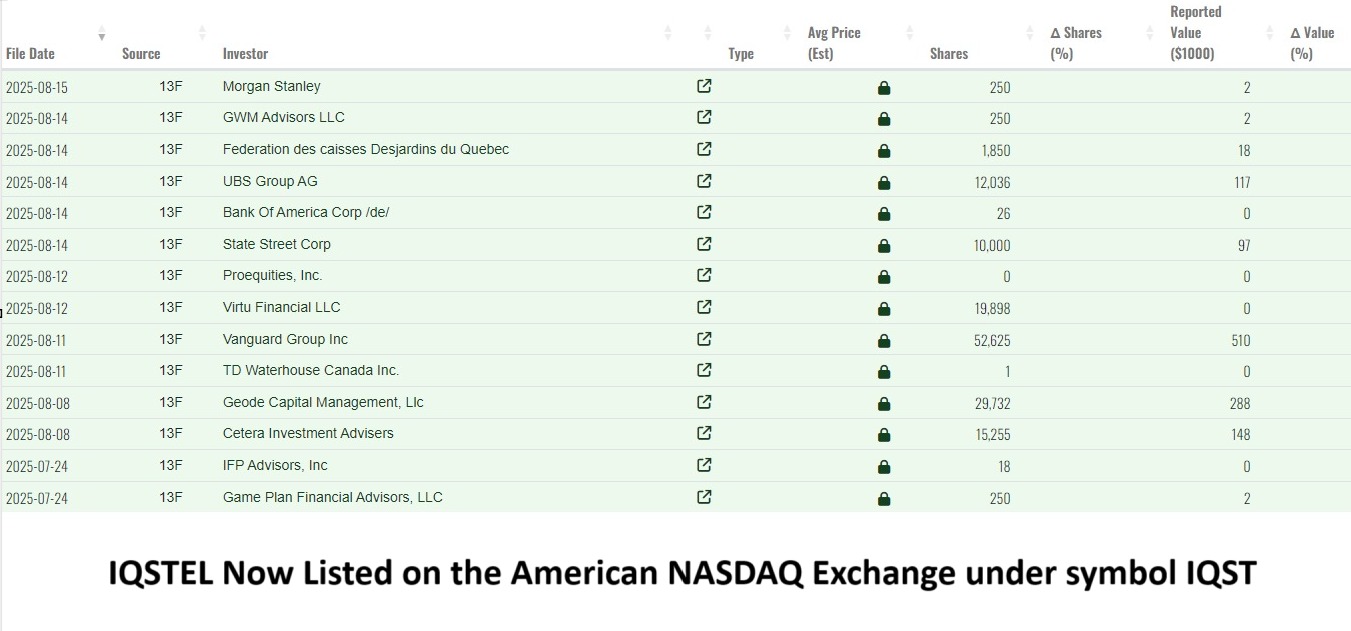

Following the N A S D A Q uplisting, IQST has expanded its institutional outreach:

- 20+ institutional investors now hold approximately 5% of outstanding shares

- Management initiated a webinar roadshow targeting institutions and family offices

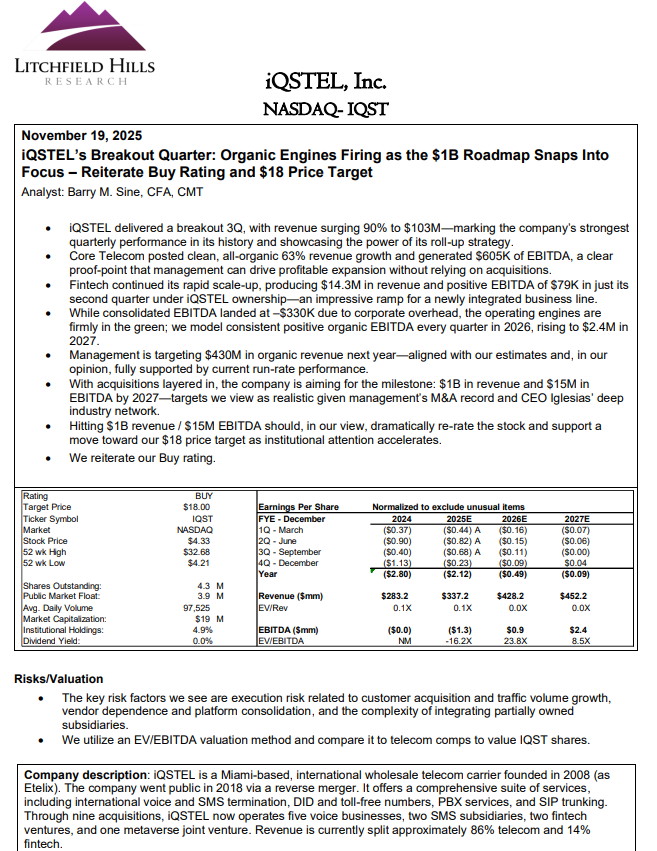

- Independent research coverage was initiated by Litchfield Hills Research, which issued a report with an $18 price target

These developments are increasing IQST's visibility among long-term investors as it transitions into its next growth phase.

Looking Ahead: Execution and Scale in 2026

With foundational milestones achieved, IQST enters 2026 focused on execution:

- Scaling high-margin fintech, AI, and cybersecurity services

- Advancing toward a $15 million EBITDA run rate

- Continuing progress toward a $1 billion revenue objective by 2027

Following a year defined by transformation, IQST now appears positioned to capitalize on its expanded platform, strengthened balance sheet, and diversified revenue streams—setting the stage for what could be its most consequential growth phase yet.

For more information on $IQST visit: www.IQSTEL.com and www.landingpage.iqstel.com

Company Contact:

IQSTEL, Inc. (N A S D A Q: IQST)

Leandro Jose Iglesias, President & CEO

investors@iqstel.com

+1 954-951-8191

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: CorporateAds

Filed Under: Business

0 Comments

Latest on The PennZone

- Senseeker Machining Company Acquires Axis Machine to Establish Machining Capability for Improved Supply Chain Control and Shorter Delivery Times

- VC Fast Pitch Is Coming to Maryland on March 26th

- Patent Bar Exam Candidates Achieve 30% Higher Pass Rates with Wysebridge's 2026 Platform

- Municipal Carbon Field Guide Launched by LandConnect -- New Revenue Streams for Cities Managing Vacant Land

- Hoy Law Wins Supreme Court Decision Establishing Federal Trucking Regulations as the Standard of Care in South Dakota

- Dr. Rashad Richey's Indisputable Shatters Records, Over 1 Billion YouTube Views, Top 1% Podcast, 3.2 Million Viewers Daily

- Lee, Miller, Quesada Featured in Standout FAN EXPO Philadelphia Creator Lineup, May 29-31

- Grand Opening: New Single-Family Homes Now Open for Sale at Heritage at Manalapan

- Radiant Floor Heating & Tile: Why More Chester County Homeowners Are Choosing Comfort Over Convention

- Shelter Structures America Announces Distribution Partnership with The DuraTrac Group

- The OpenSSL Corporation Releases Its Annual Report 2025

- Iranian-Born Engineer Mohsen Bahmani Introduces Propeller-Less Propulsion for Urban Air Mobility

- Aleen Inc. (C S E: ALEN.U) Advances Digital Wellness Vision with Streamlined Platform Navigation and Long-Term Growth Strategy

- RimbaMindaAI Officially Launches Version 3.0 Following Strategic Breakthrough in Malaysian Market Analysis

- Fed Rate Pause & Dow 50k: Irfan Zuyrel on Liquidity Shifts, Crypto Volatility, and the ASEAN Opportunity

- 20/20 Institute Launches Updated Vision Correction Procedures Page for Denver & Colorado Springs

- OneVizion Announces Next Phase of Growth as Brad Kitchens Joins Board of Directors

- New Children's Picture Book "Diwa of Mount Luntian" Focuses on Calm, Culture, and Connection for Today's Families

- Actor, Spokesperson Rio Rocket Featured in "Switch to AT&T" Campaign Showing How Customers Can BYOD and Keep Their Number

- The World's No.1 Superstar® Brings Disco Fever Back With New Global Single and Video "Disco Dancing"