Trending...

- Rep. Gina H. Curry and Dr. Conan Tu Inspire at Kopp Foundation for Diabetes Hybrid Fundraising Gala and National Leadership Forum

- RNHA FL Unveils Bold New Leadership Ahead of 2026 Elections

- Mullins McLeod Surges Into SC Governor's Race with $1.4 Million Raised in First Quarter; Most from His Own Commitment, Not Political Pockets

$IQST Institutions are Buying...Why? IQST is Undervalued at $7

CORAL GABLES, Fla. - PennZone -- August 2025 — In a marketplace increasingly defined by rapid innovation, IQSTEL, Inc. (N A S D A Q: IQST) is emerging as a rare standout — delivering real revenues, rapid profitability milestones, and strategic diversification across the most exciting sectors in tech: telecom, fintech, electric vehicles, artificial intelligence, and cybersecurity.

With a current $400 million annual revenue run rate, a new $15 million EBITDA run rate plan for 2026, and a bold $1 billion revenue target for 2027, IQST is not just projecting future growth — it's actively engineering it.

IQST by the Numbers: Why Investors Are Paying Attention

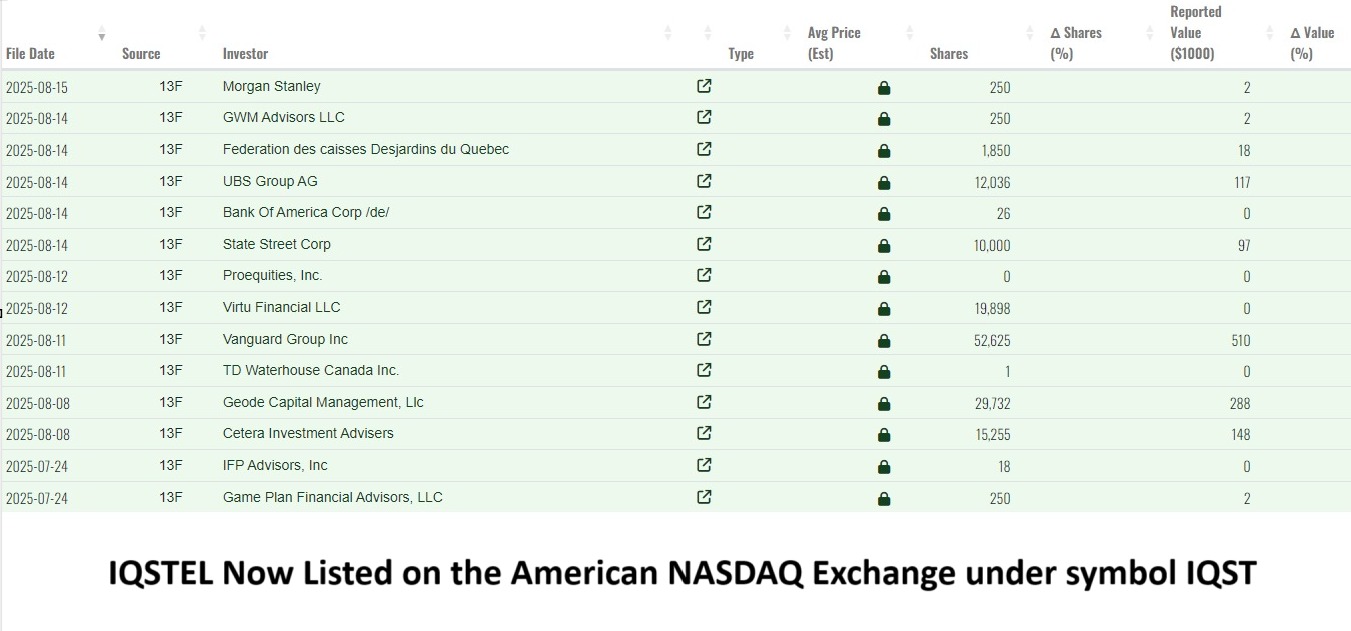

Institutions are Buying $IQST:

https://lnkd.in/gqu2dKnY

Strategic Execution: IQST's Roadmap to $1B

On August 25th, IQST unveiled the next phase of its expansion strategy: a $15 million EBITDA run rate goal by 2026 to drive valuation while laying the foundation for $1 billion in revenue by 2027.

This two-pronged "pincer strategy" is built on:

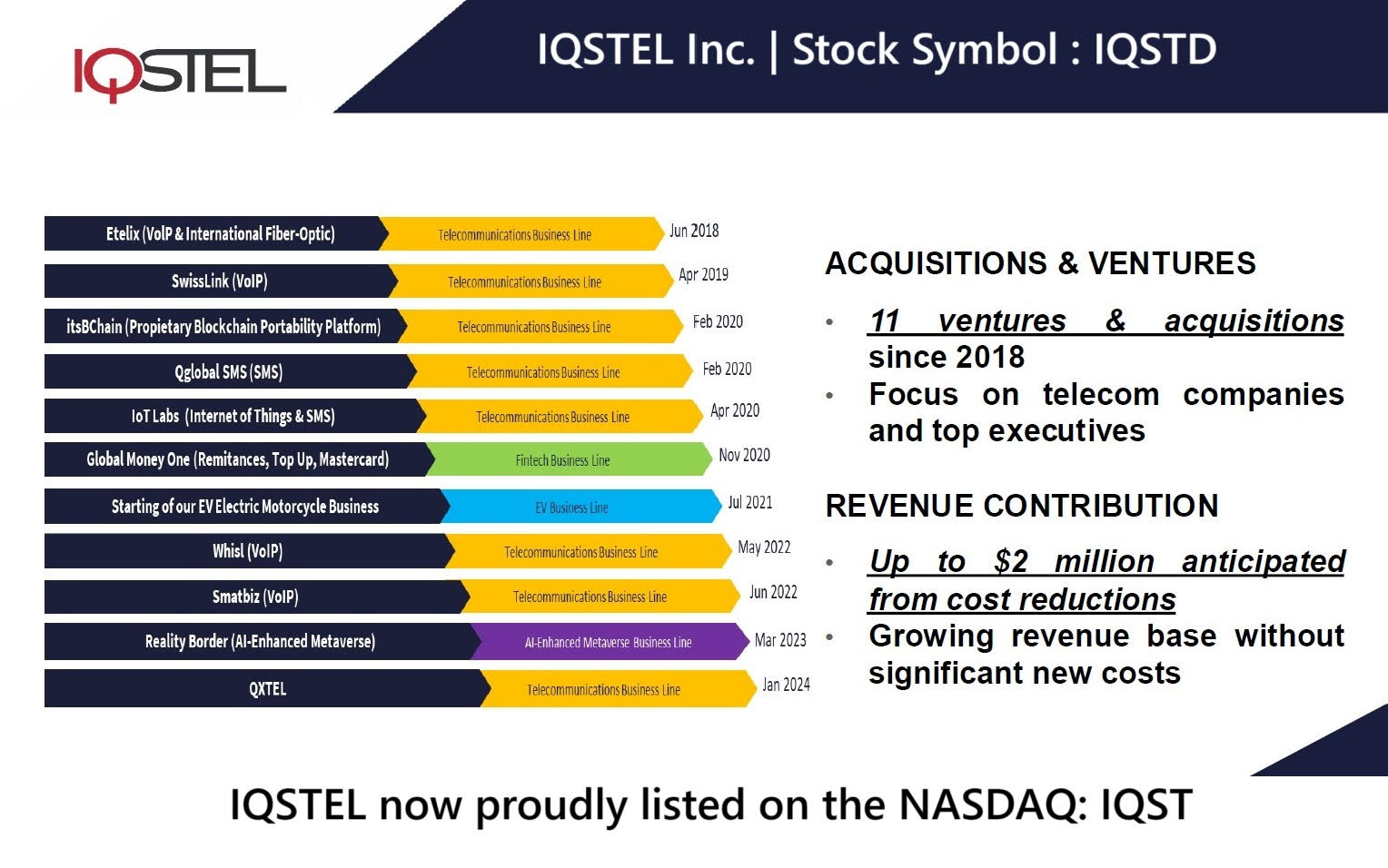

1. Strategic Acquisitions

More on The PennZone

IQST is currently vetting 2–3 high-margin acquisition targets — each expected to contribute approximately $5 million in EBITDA. Funding strategies prioritize value-enhancing structures such as preferred equity and commercial bank debt, designed to protect common shareholders while accelerating growth.

2. Operational Streamlining

Across its global divisions, IQST is boosting margins through efficiency initiatives already delivering improved profitability. The telecom segment, for instance, delivered a 30% quarterly jump in net income and $1.1 million in EBITDA in just the first half of 2025.

Strong Momentum Across Key Divisions

IQST's diversified model is more than a buzzword. It's delivering:

Recent Highlights Validating the Strategy

Analyst Endorsement and Institutional Interest Rising

More on The PennZone

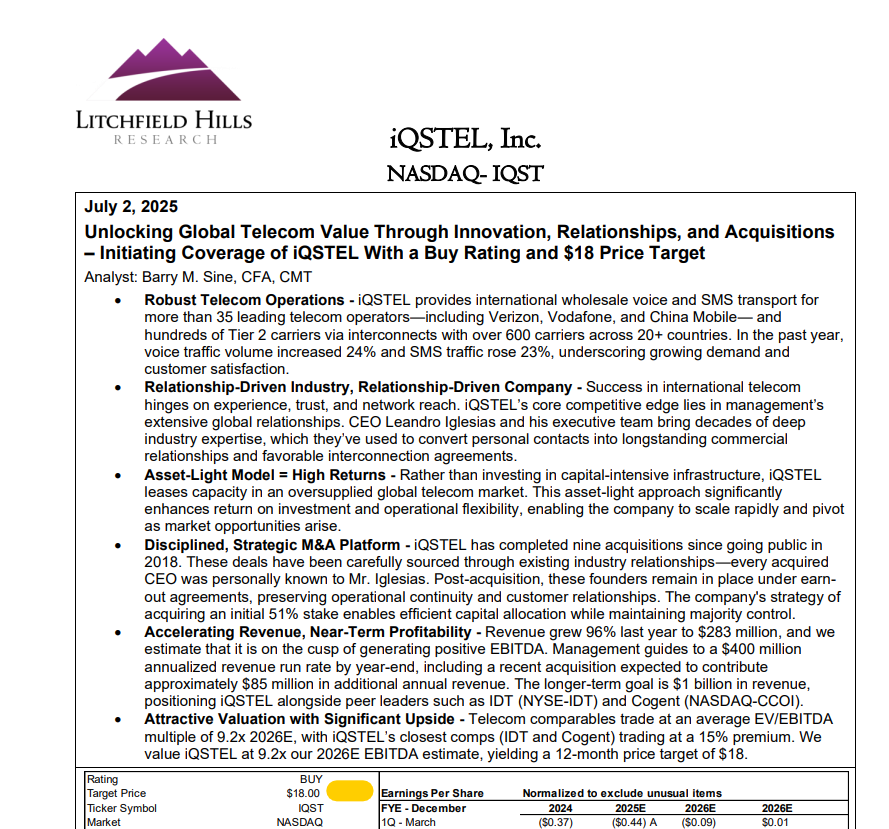

Litchfield Hills Research, a respected independent analyst firm, reaffirmed its $18 price target for IQST in August 2025, citing execution strength and financial resilience. Read the full analyst report here: Click to View

Meanwhile, IQST has attracted the attention of 12 institutional investors — building momentum only four months post-Nasdaq uplisting.

Positioned to Become a Billion-Dollar Tech Company

IQST is not in concept mode — it's in growth mode.

With $400M+ in current revenue momentum, a path to $15M EBITDA, an expanding global footprint across 21 countries, and multiple high-growth verticals scaling in parallel, IQST is poised to enter the elite tier of billion-dollar revenue tech firms by 2027.

Whether through strategic acquisitions, AI-driven innovation, or shareholder-enhancing moves like the recent dividend-linked equity exchange, IQSTEL is building real value — and fast.

📈 Investor Takeaway

IQST is executing on every front: revenue growth, margin expansion, shareholder value, and future-proof technology. With its revenue already tracking ahead of plan, and debt reduced to strengthen equity, IQST stands as a compelling play for investors seeking exposure to the converging growth of fintech, AI, telecom, and cybersecurity.

In a sector where EBITDA multiples can range from 10x to 20x, hitting a $15 million EBITDA run rate could imply a valuation of $150M to $300M — well above current levels, with plenty of room to grow toward its $1B goal.

📌 Ticker: $IQST

🌐 Website: www.IQSTEL.com

📧 Investor Relations: investors@iqstel.com

📞 Phone: +1 954-951-8191

Disclaimer: This article is for informational purposes only and should not be considered investment advice. Always conduct your own due diligence. https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

With a current $400 million annual revenue run rate, a new $15 million EBITDA run rate plan for 2026, and a bold $1 billion revenue target for 2027, IQST is not just projecting future growth — it's actively engineering it.

IQST by the Numbers: Why Investors Are Paying Attention

- $35M in July revenue alone — puts the company ahead of schedule on its $400M+ run rate

- $17.41 in assets per share, equity per share up to $4.84

- $6.9M in debt eliminated, or nearly $2 per share, strengthening the balance sheet

- Litchfield Hills Research reaffirms $18 price target, citing strong Q2 performance

- New dividend catalyst: IQST shareholders to receive shares in ASII as part of Nasdaq uplisting strategy

Institutions are Buying $IQST:

https://lnkd.in/gqu2dKnY

Strategic Execution: IQST's Roadmap to $1B

On August 25th, IQST unveiled the next phase of its expansion strategy: a $15 million EBITDA run rate goal by 2026 to drive valuation while laying the foundation for $1 billion in revenue by 2027.

This two-pronged "pincer strategy" is built on:

1. Strategic Acquisitions

More on The PennZone

- Airbus Defence and Space and Omnitronics Sign MoU to Advance Interoperability in Critical Communications

- Award-Winning Philadelphia Area Author, Tom Tracy, Launches Catalog of Diverse Kids Books to Counter Book Bans and DE&I Rollbacks

- White Glove Restoration Sends "Help in Boxes" to Support Communities in Ghana

- NASA Agreements, New Ocean Exploration Applications Added to Partnerships with Defiant Space Corp and Emtel Energy USA for Solar Tech Leader: $ASTI

- Chic and Secure: The Blue Luna Debuts Stylish Keychains with Purpose

IQST is currently vetting 2–3 high-margin acquisition targets — each expected to contribute approximately $5 million in EBITDA. Funding strategies prioritize value-enhancing structures such as preferred equity and commercial bank debt, designed to protect common shareholders while accelerating growth.

2. Operational Streamlining

Across its global divisions, IQST is boosting margins through efficiency initiatives already delivering improved profitability. The telecom segment, for instance, delivered a 30% quarterly jump in net income and $1.1 million in EBITDA in just the first half of 2025.

Strong Momentum Across Key Divisions

IQST's diversified model is more than a buzzword. It's delivering:

- Telecom: $600M+ in historical revenue, strong recurring business, trusted by 600+ operators worldwide

- Fintech: Expansion accelerated by the July 1st acquisition of GlobeTopper, forecasting $34M in H2 revenue and positive EBITDA

- AI: Launch of IQ2Call — an AI-powered, multilingual call center disrupting the $750B global telecom customer service market

- Cybersecurity & Blockchain: Active product development underway to support enterprise and consumer needs globally

Recent Highlights Validating the Strategy

- Q2 2025 Financials (Ended June 30, 2025):

- Gross revenues grew 17% YoY (100% organic growth)

- Gross margin improved by 7.45%

- Net shareholder equity up 20% in 6 months

- Common equity conversions absorbed by the market with no dilution impact

- Equity Exchange and Dividend Partnership with CYCU:

- IQST and CYCU signed an MOU for mutual equity stakes and shareholder dividends in each company — strengthening IQST's shareholder value proposition

Analyst Endorsement and Institutional Interest Rising

More on The PennZone

- BEC Technologies Showcases Leadership in Private Broadband Ecosystem with Inclusion in UTC's Ecosystem Summary Report

- $500,000 in Stock Dividend for Shareholders in 2025 Sweetens The Pot on Success of Becoming Debt Free with No Convertible Notes or Warrants for $IQST

- Milwaukee Job Corps Center: Essential Workforce Training—Admissions Now Open

- Aissist.io Launches Hybrid AI Workforce to Solve AI Pilot Failure for Customer Support Automation

- Christy Sports Makes Snowsports More Accessible for Families to Get Outside Together

Litchfield Hills Research, a respected independent analyst firm, reaffirmed its $18 price target for IQST in August 2025, citing execution strength and financial resilience. Read the full analyst report here: Click to View

Meanwhile, IQST has attracted the attention of 12 institutional investors — building momentum only four months post-Nasdaq uplisting.

Positioned to Become a Billion-Dollar Tech Company

IQST is not in concept mode — it's in growth mode.

With $400M+ in current revenue momentum, a path to $15M EBITDA, an expanding global footprint across 21 countries, and multiple high-growth verticals scaling in parallel, IQST is poised to enter the elite tier of billion-dollar revenue tech firms by 2027.

Whether through strategic acquisitions, AI-driven innovation, or shareholder-enhancing moves like the recent dividend-linked equity exchange, IQSTEL is building real value — and fast.

📈 Investor Takeaway

IQST is executing on every front: revenue growth, margin expansion, shareholder value, and future-proof technology. With its revenue already tracking ahead of plan, and debt reduced to strengthen equity, IQST stands as a compelling play for investors seeking exposure to the converging growth of fintech, AI, telecom, and cybersecurity.

In a sector where EBITDA multiples can range from 10x to 20x, hitting a $15 million EBITDA run rate could imply a valuation of $150M to $300M — well above current levels, with plenty of room to grow toward its $1B goal.

📌 Ticker: $IQST

🌐 Website: www.IQSTEL.com

📧 Investor Relations: investors@iqstel.com

📞 Phone: +1 954-951-8191

Disclaimer: This article is for informational purposes only and should not be considered investment advice. Always conduct your own due diligence. https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: Corporate Ads

0 Comments

Latest on The PennZone

- RJ Grimshaw Launches "The AI EDGE" A Practical Guide Where Leadership Meets Innovation

- Probate Shepherd® Announces a New Member Probate Attorney in Sugar Land, TX

- Unconventional Storytelling: The Offbeat Charm of an Intersectional Narrative

- New Premier Indoor Golf Destination: "The Golf Place" Grand Opening Set 10/25

- Live Good Leads with Love: Creating Opportunity, Protecting the Vulnerable and Inspiring Hope

- Probate Shepherd® Announces a New Member Probate Attorney in The Woodlands, TX

- Probate Shepherd® Announces a New Member Probate Attorney in Conroe, TX

- Taraji P. Henson's Boris Lawrence Henson Foundation (BLHF) Announce 5th Annual Can We Talk? Arts & Wellness Summit and "i AM The Table Benefit Brunch

- Bright Hope Baptist Church Fall Bazaar - A Day of Community, Creativity, and Celebration

- Pickeyweedz opens new store in Archbald, PA

- Mullins McLeod Surges Into SC Governor's Race with $1.4 Million Raised in First Quarter; Most from His Own Commitment, Not Political Pockets

- Wise Business Plans Strengthens Business Plan Writing Services throughout Pennsylvania

- Mensa Members Put Brainpower to Work for Literacy

- Rep. Gina H. Curry and Dr. Conan Tu Inspire at Kopp Foundation for Diabetes Hybrid Fundraising Gala and National Leadership Forum

- Elliott Expands Investment Services with Naviark App Launch

- Nola Blue Records signs The Anthony Paule Soul Orchestra feat. Willy Jordan

- Restoration Dental Introduces YOMI Robot for High-Precision Implant Surgery in Oklahoma

- LINC Hosts Successful 3rd Biennial C-Suite Leadership Summit

- Elite Rooter Creates Jobs and Expands Reach Coast to Coast with New Tampa, FL Plumbing Location

- "Super Leftist", the new poetry book by Pierre Gervois